Albion Park Property Market Analysis: Growth, Trends, and Investment Potential

Market Performance: Steady Growth in a Maturing Market

Albion Park’s housing market shows resilience with a current median house price of $870,000, representing a 2.4% growth over the previous period. This moderate but positive growth trajectory indicates a stable market environment that continues to attract both homeowners and investors.

According to the Leverage Listings report, there were 184 house sales recorded in the 12-month period from April 2024 to March 2025. This transaction volume demonstrates healthy market activity despite broader economic challenges, suggesting ongoing demand for properties in this area.

The price range segmentation shows the majority of sales occurring in the $800,000-$900,000 bracket, indicating a well-defined market sweet spot. High-end properties exceeding $1 million are also seeing consistent transaction activity, pointing to market depth across different price points.

Historical Growth: Long-Term Value Appreciation

Examining Albion Park’s historical performance reveals an impressive growth story with several notable periods:

- 2014-2017: The market experienced exceptional consecutive years of double-digit growth (12.9% in 2014, 10.2% in 2015, 11.4% in 2016, and 13.8% in 2017)

- 2018-2020: Growth moderated with a slight correction (-4.7%) in 2019 before rebounding

- 2021-2022: The post-pandemic boom delivered extraordinary results with 20.2% growth in 2021 followed by 16.1% in 2022

- 2023-2025: The market entered a stabilization phase with a minor correction (-2.9%) in 2023 before returning to positive growth

This historical pattern demonstrates Albion Park’s resilience through various market cycles. Over the 18-year period documented (2007-2025), the median house price grew from $345,000 to $880,000, representing a 155% increase or approximately 5.4% annualized growth—significantly outperforming inflation.

Rental Market: Strong Yields and Consistent Demand

Albion Park offers attractive investment potential with a current rental yield of 4.1% for houses and an even stronger 4.6% for units. These yields compare favorably against metropolitan averages and provide investors with solid cash flow prospects.

The median weekly rent for houses stands at $690, supported by consistent demand as evidenced by the 128 rental transactions recorded in the past 12 months. The rental market shows seasonal patterns with peak activity occurring in September-October, valuable intelligence for investors timing their market entry.

Recent rental listings show a diverse range of properties from $600 to $820 per week, with most being family homes featuring 3-4 bedrooms. This aligns well with the demographic profile of renters in the area, primarily consisting of families seeking space and amenities.

Recent Sales: Price Points and Property Characteristics

Recent transactions provide valuable insights into buyer preferences and market dynamics:

- Premium Segment: Properties like 21 Chaplin PL ($1,410,000) and 3 Collie Way ($1,041,000) demonstrate strong demand for large, well-appointed family homes with 4+ bedrooms and multiple living areas

- Mid-Range Market: Properties such as 1 Hughes DR ($870,000) and 9 Upland CH ($855,000) represent the core market, typically offering 3-4 bedrooms on standard blocks

- Entry Level: Properties like 11 Mountainview Mews ($670,000) provide entry points for first-time buyers and investors

The days-on-market metrics vary significantly, from properties selling within 9 days (12 Charlotte Cres) to others requiring 201 days (20 Chaffey Way), indicating buyer selectivity and price sensitivity despite overall market health.

Market Outlook and Investment Potential

Albion Park presents compelling investment characteristics for several reasons:

- Sustainable Growth Trajectory: After the exceptional growth years of 2021-2022, the market has returned to a more sustainable growth pattern of 2-3% annually, suggesting reduced volatility risk

- Strong Rental Returns: With rental yields exceeding 4%, investors can achieve positive cash flow outcomes even in the current higher interest rate environment

- Diverse Housing Stock: The suburb offers investment opportunities across various price points and property types, allowing portfolio diversification

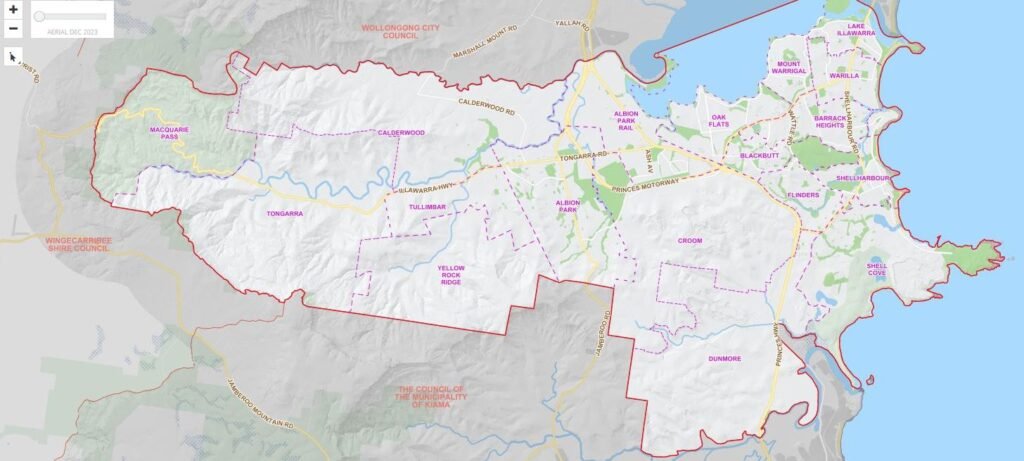

- Infrastructure and Amenities: The aerial map highlights good transport links and green spaces, contributing to ongoing appeal for both owners and renters

- Price Stability: Despite minor fluctuations, the market has demonstrated resilience with a quick return to growth following the small correction in 2023

Potential investors should note that September-October appear to be peak selling periods, which may influence timing decisions for both entry and exit strategies. Additionally, the price range segmentation indicates strongest activity in the $800,000-$900,000 bracket, suggesting optimal investment targets.

Conclusion: A Market Balancing Growth and Stability

Albion Park represents a balanced investment proposition combining moderate capital growth with strong rental returns. The historical data reveals a market that has matured beyond the volatile growth phases of the pandemic period but continues to deliver steady appreciation.

For investors seeking sustainable returns rather than speculative gains, Albion Park offers compelling value. The 4.1% rental yield provides a buffer against interest rate fluctuations, while the consistent transaction volume indicates ongoing market liquidity—an important consideration for future exit strategies.

The suburb’s diverse housing stock, from entry-level units to premium family homes, allows investors to target specific market segments based on their investment objectives and risk profiles. As the market continues its steady growth trajectory, Albion Park stands out as a residential property market combining stability with reasonable growth prospects.

Data source: Suburb Report prepared by Gaurav Singh, Leverage Listings (May 12th, 2025)

Disclaimer: This Article is intended for informational purposes only and does not constitute financial or investment advice.